Freedom

It is so important |

New editorial team

APEurope editorial

info@apeurope.org

Announcement

The editorial team of Emancipation has changed as a result of the end of the 2019 franchise editorial contract.

This is the second edition of Real News Online which will be produced as a concise Quarterly.

Emphasis will be on current affairs from the standpoint of constitution and constitutional economics as a basis for sustaining social wellbeing through freedom of choice and peaceful co-existence.

January, 2021 |

|

|

Because of its contemporary and future importance, we had made the following topic the leading theme for 2018 but the situation only got worse so it remained the principal theme for 2019 and 2020 and even more than before, in 2021 this will remain the principle theme covered by this medium even under new management. Contributions to this theme are listed below the title.

With freedom threatened by the politics of aggression & fear, we need impartial media There is a growing epidemic in media of all types in tendentious manipulation of information by the larger search engine and social media organizations and advertising systems as well as the so-called mainstream media. Our editorial team is preparing articles to cover this critical topic in some detail and these will be added to this thread as they are finalized. |

|

|

Why monetary theory & practice are flawed

Why monetary theory & practice are flawed

24/06/2024: Our recent interview with the economist Hector McNeill describing the Real Incomes Approach to Economics created a good deal of interest because it is a distinct alternative to conventional policies. In this followup interview McNeill explains why monetary theory is flawed and he spells out the consequences. Read more...

Labour aims for growth but how much and of what type of growth is needed? Labour aims for growth but how much and of what type of growth is needed?16/06/2024: Nevit Turk, the Senior Economics Correspondent of APE, Paris, interviews the constitutional economist Hector McNeill to review the Labour Party Manifesto. This is provided in the light of the findings in McNeill's latest publication entitled, " The Economic Consequences of the Bank of England"" which will be pulished end of June 2024. Read more...

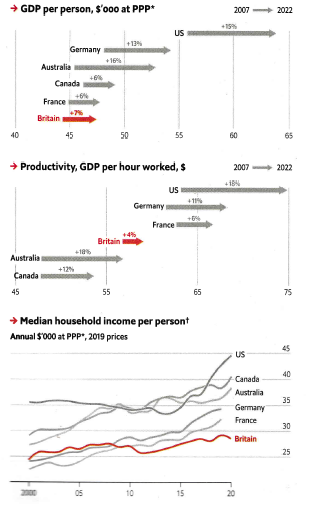

Why the British economy is not performing The The Economist Newspaper harticle entitled "Declinism and data" which charts the across-the-board failings of the British economy. Oddly enough this article does not refer to the main problem with the economy. This is that we do not produce and sell enough things at competitive prices that the world wants to buy. As a result, our balance of payments in goods is the second worst in the global BoP league table for goods.  Nicholas Kaldor Nicholas Kaldor |

In 1966, Nicholas Kaldor, in his inaugural lecture as Professor of Economics at Cambridge University, explained why industry and manufacturing was essential for the county's future economic performance and survival. Following the energy price crisis starting in 1973 with the OPEC sanctions against petroleum importers, Kaldor advised Denis Healey against switching to monetarism. Kaldor explained that in promoting monetarism we would end up in a weak position. Our current BoP and the Economist article prove Kaldor was right. Unlike most economists, Kaldor understood the role of in-country technology and productivity in maintaining consumption and innovation to the benefit of all sectors. Kaldor also understood that economies did not return naturally to points of equilibrium when technological innovation was under way but that growing economies are in a constant disequilibrium somewhat along the lines of Schumpeter's " creative "destruction". Rather than promote such a basis for growth, monetarism was expanded with some enthusiasm by the Thatcher government and by all governments ever since. Globalism was promoted which saw British capital invested in foreign lower wage economies rather than in the United Kingdom. As a result, between 1975 and 2022 industrial and manufacturing investment declined along with productivity. The workforce was de-skilled and the service economy grew on the basis of lower real wages. The tail end of this fiasco can be seen in the graphs on the left from the Economist article.  Friedman Friedman |

Kaldor was a critic of some of the work by Milton Friedman a professor at the University of Chicago and the Patron Saint of monetarism. Kaldor explained why some of his work was flawed. For example, Kaldor explained why Friedman's assertion that the insertion of bank-sourced funds into the economy, as an exogenous factor, creates demand and therefore creates economic growth was " .. the wrong way around". Kaldor explained that growth arises from supply side production decisions to invest and therefore the origination of "demand" is generated by industry and manufacturing investment plans; it is an endogenous factor. In an exchange of views on this matter between Kaldor and Friedman in the Llyods Bank Review in 1970, Friedman, at a loss to justify his position, attempted to shore up his position by belittling Kaldor by referring to him as " Johnny come lately". Writing in the British Strategic Review 2022, the economist Hector Wetherell McNeill, a graduate of Cambridge and Coordinator of SEEL-Systems Engineering Economics Lab, records that he had observed how, in the 1970s, Friedman could never explain the mechanisms of how money volumes create inflation. The best he could do was to assert, " It happens in the long run!" As McNeill wryly observed, " .. this is not a mechanism". Theories of money

The Quantity Theory of Money (QTM) identity by Irving Fisher:

M.V = P.Y ..... (i)

Where, M is the volume of money; V is the velocity of circulation; P is the average price of goods and services; Y is the quantity of goods and services purchaseor real income. The Real Money Theory (RMT) identity by Hector McNeill:

(M-(l+r+p+m+a+h+f+c+o+s)).V = P.Y ..... (ii) The Cambridge University economists John Maynard Keynes, Arthur Pigou and Alfred Marshall attempted to improve the QTM but only progressed as far as adding savings (s) to the QTM creating what became known as the Cambridge Equation. McNeill, however, advanced this work far further by integrating all of the principal relevant factors that determine prices of goods and services in relation to money volumes by reducing the proportion of money in goods and service transactions. The RMT represented above indicates that this proportion is reduced by the sums that contiunue to flow into assets causing more significant price rises in these markets than in goods and services markets. As a result McNeill's RMT identity represents a more complete and accurate identity.

Reference: British Strategic Review, Note 11, "Monetary Deception", 2022.Note: The 10 missing variables from the QTM i.e. the reason it is quite wrong include: l, r, p, m, a, h, f, c, o and s.

|

|

|

Neild Neild |

In 2014, the economist Robert Neild, Professorof Economics at Cambridge University, commented on Friedman's habit of making fun of people when he was cornered to detract from his inabilty to respond to logical questions. For example, Friedman could not explain how the economy would return to equilibrium after Geoffrey Howe's disastrous budget in 1981 and therefore resorted to sarcasm and humour to belittle Robert Neild in a public debate.  McNeill McNeill |

The most effective demolition of monetary theory was Hector McNeill's proof that the Holy Grail of monetarism, the Quantity Theory of Money (QTM), is without any merit at all. The QTM is supposed to explain the relationship between the volume of money in an economy (M) and the average prices of goods and services (P). Using the outcome of 12 years of quantitative easing (QE), McNeill explained that the simplistic QTM lacks some ten essential variables that together determine prices of goods and services in an economy. The missing variables include the asset markets for land "l", real estate "r", precious metals "p", commodities "m", Art objects "a", shares "h", financial instruments "f" and crypto-currencies "c" as well as the funds flowing overseas "o" and savings "s" (see box on the right). Unlike Friedman, McNeill has also explained why money volume expansion under monetary policy gives rise to inflation by describing the mechanisms involved. He has also explained why and how the default outcome of monetarism is rising wealth of asset holders and traders and a steady decline in real wages. This is related to the very different characteristics of the domestic economies of wage earners and asset market participants. This is something Margaret Thatcher did not understand with her simplistic " kitchen sink" economic theories. McNeill considers this skew to represent an unacceptable constitutional crisis which continues to push the British economy to ruin. The alarming current issue is that since a completely flawed economic policy theory is still taught in the "best universities", the government and Bank of England continue to pursue self-destructive policies. How the government is destroying the prospects of Britain 20/11/2022:Recently Jeremy Corbyn posted the following Tweet, "I condemn the Russian invasion, the war against Ukraine and the illegal occupation.

Today, I asked the Foreign Secretary what role the UN can play in bringing about a process of peace to prevent any further loss of life." |

The website Corbynista.org, has begun to post Corbyn's Tweets and replies received. However, the degree of disinformation expressed in responses to this Tweet, was notable. As a result, APEurope Correspondents Pool suggested to Corbynista.org, in good faith, that they should provide a background explanation to the Ukrainian crisis to clarify specific issues. This was produced and once published, Corbynista.org received a large email response asking if what they had stated was in fact true while others accused Corbynista.org of being Putin apologists or Russian agents. However, Corbynista.org, in spite of its name, has nothing to do with Jeremy Corbyn nor is it a Russian agent; it is an independent member of the APEurope media group whose main mission is to inform the public of facts. This raised concern about the widespread disinformation concerning the origins, motivations and progress of the Ukrainian conflict. It also demonstrated a failure of people to make a direct connection between our government's own decisions and our current economic crisis. Therefore, APEurope Correspondents' Pool decided to turn their Corbynista.org background explanation into an article. Read more ... Rational economics in an irrational worldStudies by the RAND Corp have confirmed that economic policies in the USA have, over the last 50 years, resulted in increasing income disparity and declining real wages of people in the lowest payment scales. The same has happened in the United Kingdom. In spite of many attempts to change the direction of policy, Nevit Turk, the economics correspondent of AP Europe says that, " There remains a fixation with monetary policy and rather than explore the alternatives that existed before monetarism took over. As a result, all of the propositions are variants of monetarism. However, all known variants have been deployed without success." A relatively recent online resource, Beneficial Economics ( Benecon.UK ) describes its mission as follows: "Beneficial Economics (Benecon) is an occasional publication that identifies advances in contributions to economics that are believed to have the potential to contribute to a beneficial practical applications in policy and economic activities." Naturally, given the state of advance of economics it is a wonder Benecon has found anything to promote. However, looking through their recommendations it is evident that there is a potentially important area where most of the original and increasingly practical propositions are being advanced. The output of SEEL-Systems Engineering Economics Lab, Hampshire, UK, is gaining some ground. SEEL is the international centre for the development of the real incomes approach to economics. Their Strategic Decision Analysis Group also publish the annual British Strategic Review (BSR). SEEL was established by the Cambridge and Stanford university trained economist and systems engineer, Hector McNeill in 1983. It principal objectives was to monitor and analyse the expanding socio-economic applications of technology on global networks. He modelled SEEL on the former Decision Analysis Group at Stanford Research Institute headed by Ronald Howard and the systems enginneering economic approach applied by Bruce Lusignan at the Engineering School at Stanford. McNeill was a TA to Lusignan dealing with population and food supplies and global carrying capacity isues. At a recent AP Europe Correspondents' Workshop (16 July, 2022) Hector McNeill stated that,  "After almost 45 years of development the real incomes approach has arrived at a point where, both in theoretical and policy terms, it has become a distinct non-monetarist movement. The monetary expansion during the last 50 years has seen spiralling debt and plummeting productivity and declining real incomes. This has resulted in an endemic inflationary path. As a result monetarism has created significant socio-economic problems; this is a constitutional issue. Therefore, it is clear that there is a need to terminate the expansion in money volumes and to stabilize growth around a stable money volume but rising productivity." "After almost 45 years of development the real incomes approach has arrived at a point where, both in theoretical and policy terms, it has become a distinct non-monetarist movement. The monetary expansion during the last 50 years has seen spiralling debt and plummeting productivity and declining real incomes. This has resulted in an endemic inflationary path. As a result monetarism has created significant socio-economic problems; this is a constitutional issue. Therefore, it is clear that there is a need to terminate the expansion in money volumes and to stabilize growth around a stable money volume but rising productivity." A recent BSR Note 6 spells out the main constitutional issues McNeill refers to: The constitutional crisis created by monetary policyA group that has picked up this real incomes movement banner is the Cambridge Economics Network. Because of the deepening cost of living crisis, recently the British Strategic Review, unusually, produced an additional Special Edition entitled "Monetarism & The Cost of Living" to explain how the real incomes approach and Real Incomes Policy (RIP) provides a basis for a solution. This Special Edition was posted on the BSR website on 18 July 2022. The need to curtail monetary expansion

Nevit Turk mentioned that the economist Saifedean Ammous surveyed the historic data on monetary expansion across several countries and recounted how the recent rates of expansion exceed most historic records which invariably resulted in socio-economic problems, income disparity, violence and even warfare.

The real incomes approach is based on a Real Money Theory which emphasizes a more effective control over monetary expansion and the reduction in income disparity. |

|

|

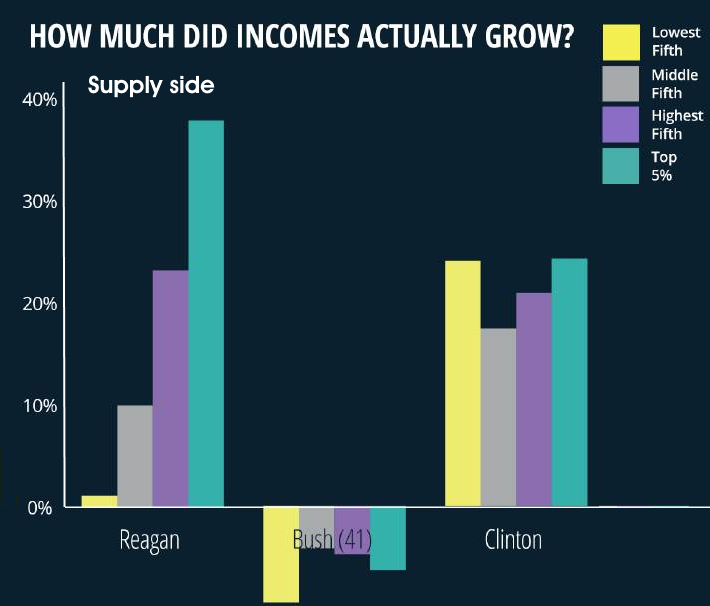

Nevit Turk's reaction to this new publication is that, "This is a really interesting document. You will not find this content in any other economics text. It is more like a economic textbook introducing a new approach to economic theory and policy. It explains in forensic detail that monetary theory is, in reality, wrong and the evidence used is there for all to see in the results of quantitative easing (QE), which did not turn out as expected. This document also describes a completely new analysis of supply and demand questions called transactional envelopes within which all transaction for goods take place and where it is possible to see occluded areas where low income segments cannot purchase their basic essentials. I have never seen this type of analysis before, but it is typical of the output of SEEL who are advancing the leading edge of economic theory and practice.". At the AP Europe Correspondents' Pool Workshop in Hampshire, Nevit Turk said that in a side conversation, McNeill informed him that the Cambridge Economics Network will soon release a paper which will place the real incomes approach as the most likely to be the most successful replacement for monetarism, Keynesianism, supply side economics and modern monetary theory. This is based on an analysis McNeill completed two years ago that replaced a proven to be defunct Quantity Theory of Money (QTM) with a more realistic and intelligible Real Money Theory (RMT). From that position, which discounts the QTM and with it much monetary theory, the paper will lay out the alternative real incomes approach in the form of Real Incomes Policy (RIP). A central aspect of this is a curtailment of monetary expansion and spiralling debt and a return to self-generated equity arising from economies made possible by increasing productivity. Investing in results This weekend's ACP workshop covered some topics of relevance to the current Conservative party selection of a new leader. This is related to the issue of balanced budgets against low taxes being a complete red herring. This relates to government expenditures. One of the reasons for the relatively wasteful investments by government is the uncertainty of the actual outcomes in terms of economic and social benefits, for example, those accruing from the HS2 rail system whose costs continue to rise beyond the original estimates. Invariably government information technology contracts have overrun original budgets. In these cases investments were made on the basis of cost-benefit analyses that assume the state of knowledge used to take decisions is advanced enough to enable estimates that take into account possible changes in conditions. In other words, investments are made with no clear or reliable idea of the results. On the other hand, besides having to deal with changes in conditions, there is the question of the competence of those contracted to carry out the work. In spite of leaps of faith by Labour and Conservative governments over the last 50 years, promising to grow the economy under monetarism, they have always failed to do so. This half century lack of coherence between the promise and the outcomes causes the current declarations of most Conservative party candidates for leadership of the party, to have a whiff of fantasy about them. The Conservatives have an ideological fixation with the concept of small government and tax cuts counter-balanced by the continued assertion that this can then "grow the economy". This is the 1970s supply side paradigm which has never worked out in practice. In any case the main issue facing the country is inflation and increasing income disparity with many being unable to buy basic essentials. The main attempts to apply the supply side, small government and low tax formula were the administrations of Ronald Reagan in the USA and Margaret Thatcher in the UK. In both cases this depressed the economy, led to widespread repossessions of homes and family farms and income disparity increased.  The result of Reagan's experiment with supply side economics can be observed in the diagram on the right. Under Reagan income disparity rose with the highest income earners, the top 5%, seeing their incomes rise by 47% and those on lower incomes by just 2%. Under Bill Clinton, who terminated supply side economics, results were far more balanced with all income levels rising by around 20%. The grave assertions by candidates that they can "grow the economy" under low taxation regimes is simply not supported by the evidence. On the other hand, a balanced budget does not advance the case because neither Labour or Conservatives have ever grown the economy in real terms even when they had more balanced budgets. The only time the UK had unprecedented real growth marked by falling income disparity and rising real wages was in the period 1945-1965 when monetarism limited to interest rates and quite deflationary, the budget was in surplus and Keynesianism was not applied because unemployment was so low. The reason this changed was the OPEC petroleum price crisis, stagflation and the recycling of petrodollars launched the world into monetarism driven by financial deregulation. Denis Healey was the very early adopter of monetarism in 1975. Ever since, the macroeconomic management of this country has remained in the clutches of monetarism. As a result politicians and economists confuse rises in the amount of money in the economy with growth when, in reality, real growth is what is important and this only takes place as a result of price moderation and continual rises in productivity. Under monetarism and supply side economics investment and productivity remain low. Therefore all of the predictions of what the results of policy will be invariably turn out wrong and create winners, losers and those who remain in a policy neutral impact state. These policies always lose effect and therefore traction. The significance of practical experience

The economist Hector McNeill, who has led the development of the real incomes approach, has observed that macroeconomists usually have some difficulty understanding the real incomes policy paradigm as a result of what appear to be preconceived fixed ideas which seem to have become embedded during their university training. He recalls that the least convincing aspects of his own university training was monetary policy and the Quantity Theory of Money (QTM) which he has since shown to be flawed in recently published papers.

On the other hand, process engineers, cost accountants and plant managers who have a more direct involvement with the practical issues have no difficulty in understanding the concepts involved in the real incomes approach. |

|

|

It is therefore notable that the development of the real incomes approach to economics can turn this paradigm on its head by ensuring that government actions can secure exactly what is intended. It is possible to gain precise cost-benefit analyses of the actual benefits of government actions precisely. In other words, the real incomes approach is not based on investments based on notions of results in the future but rather it is based on providing benefits after the desired result has been achieved. This procedure is set out in a very simple form in the latest "Note on Monetarism & The entitled, "Sustaining growth in real wages by investing in results". This explains in remarkably simple terms how the Real Incomes Policy (RIP) operates. Rather than provide a loan or grant on the basis of a "project" or "proposal" that promises to lower prices and raise productivity sometime in the future, RIP only provides the compensation of a reduction in tax against actual delivery of price reductions. Companies, to remain viable under competitive conditions, need to deliver on the subsequent required rise in productivity or receive no further benefits. RIP is very different from the normal systems of grants and loans designed to "encourage" investment, many of which have no eligibility criteria of financial criteria and no evidence that the monies will be invested in higher productivity actions. For example, the so-called “super-deductions” for the purchase of goods for companies provide a tax relief which is not checked against any progress in productivity. Indeed, like many development projects, those in receipt of funding quite often consider this as income as opposed to funding to bring about beneficial change. This has been the case with "super-deductions" which in reality are a naive initiative and significant waste of government resources since there is no guarantee of results. Indeed, this initiative with or without tax cuts or under a balance budget is an example of policy failure. Even in those cases where investment projects are funded against detailed project proposals, the World Bank (WB) figures on their own project portfolio have registered a 35% failure rate and, in the case of agricultural projects around a 45% failure rate. This failure rate is the percentage of projects that were unable to deliver the promised benefits. The annual waste worldwide on WB development projects is around $79 billion. On the other hand, the WB has admitted that whereas in the mid-1960s around 85% of WB projects were subjected to Cost-Benefit Analysis (OQSI 2021) as a basis for approval, by 2010 this figure had fallen to 20% (Independent Evaluation Group of WB). Therefore, RIP is unique in that rather than risk such failure and waste of funds, the delivery of actual results as the degree of unit price reduction achieved is what controls the degree of incentive funding received by companies in the form of a reduced levy to compensate the company for enhancing real incomes growth of the workforce and consumers. In this way, RIP sustains growth in real wages by investing in delivered results through the provision of an incentive to moderate or eliminate inflation in the short term while also sustaining medium to longer term increases in physical productivity through innovation. This provides an operational basis for a policy to sustain growth in real wages.

The quest for a unifying candidate The British Conservative party leadership contest following the resignation of Boris Johnson, has shifted from the contentious to the acrimonious; now including some particularly negative briefings. Maybe this type of behaviour is not just a Johnson trait.  There is a binary divide between the balanced budget Sunak camp and the various candidates amassing around the trickle-down lower tax totem pole. 50 years of experience with monetarism and the detailed analysis of it impacts, tell us that neither approach works, and on balance, brings increasing income disparity as a result of declining real investment. It is difficult to deny that there are some intelligent candidates, but the problem is that those schooled in the leading academic institutions for PPE and economics, cling onto theories and policy propositions long shown to be flawed. The balanced budget is static and nothing improves and lower taxation, in the name of innovation and productivity, also does not work because most of the windfall gains go into the pockets of executives. Solutions to this binary fission so far have not been advanced.  Today, Penny Mordaunt announced her candidacy. Last year Mordaunt published the book," Greater - Britain after the storm", reviewing Britain's strengths and the gaps which need to be addressed. Altogether a pragmatic piece and being prepared to say things many other candidates would prefer to avoid being so tied up in their own persona. Mordaunt commented that the leader is less important than the ship. She is right.  This sort of fits into her asociation with the Royal Navy as a reservist. Being based in Portsmouth located on Portsea Isle in Hampshire, the birthplace of Charles Dickens, the author, and Isambard Kingdom Brunel, the engineer, it might be expected that she might be able to propose solutions that make use of applied technology to the growing range of social problems in the country associated with rising income disparity. Indeed, one of her criticisms of academic training in the UK is that the over-indulgence in analysis quite often does not also include training in coming up with solutions. On the economic policy front she has a blank slate which is a definite advantage. It is important for all Conservative MPs that a proposal is made that appeals to the whole of this increasingly divided country and this does not include a balanced static budget or tax cuts but rather a dynamic and growing budget based on short term price reduction combined with medium to long term rises in productivity across all sectors of the economy. Such an approach can tackle income disparity, improve labour relations and support levelling up, in one go. Keynesianism, monetarism and supply side economics have not succeeded on this score but the real incomes approach to economics, a new alternative and more practical school of economics holds out the promise of offering policy frameworks to achieve such a comprehensive solution. Much of the background to this development can be found in the 2022 edition of the British Strategic Review, which carries the sub-title, " Monetarism & The Real Economy". We understand that a Special Edition of the British Strategic Review with the sub-title, " Monetarism & The Cost of Living", containing a more detailed explanation of real incomes policy, will be published on 17/07/2022. The consequences of being a nation of shopkeepersCambridge Economics Network has just released an important paper explaining why it is difficult to control inflation with the current economic structure. A long period of monetarism has destoyed too much industry and manufacturing leading to all round lower real incomes and growth. This paper can be accessed here:

"The consequences of being a nation of shopkeepers".

Second Edition of British Strategic Review 2022

Monetarism and the Cost of Living

In preparation

A second special edition of the British Strategic Review is in preparation. This will cover the important topic of, "Monetarism and the Cost of Living".

Based on the considerable amount of feedback received on the first edition, this special edition will include more explicit explanations as to why monetary theory and derived policies are flawed. Rather than solving the causes of the cost of living crisis, conventional policies exacerbate the state of affairs.

Unlike the petroleum price crisis of the 1970s-1980s created by sanctions imposed by OPEC, the current crisis has been created as a result of inappropriate foreign policy decisions by petroleum and gas importing countries. These decisions are of a political character and were taken without due regard or full understanding of the economic consequences for their own economies.

Whereas monetarism cannot reverse inflationary price rises in the short term, this edition of the Review will describe how more appropriate policies can achieve this.

This special edition will be published in July 2022.

British Strategic Review 2022

Monetarism & The Real Economy

The full Review now available free of charge

The Board of the George Boole Foundation, in collaboration with Hambrook Publishing Company, has authorised the sponsorship of the free distribution of the British Strategic Review 2022. The free copies are available in EPUB and PDF formats.

Each formatted copy is in a ZIP file to facilitate the handling of downloads on some browsers. Files sizes are: PDF version 1.573 k and the EPUB version 1.830 k.

Why inflation is likely to exceed 15%

Irrespective of the predictions that inflation will slow down early next year, ill-advised political decisions on the collective foreign policy front (USA, UK, EU), have set in motion a process that will cause a cascade of effects that will drive inflation to at least 15%. 15% inflation is equivalent to a drop in real incomes of over 80% in a decade. This was is the conclusion at a mid-week workshop (Wednesday, 06/2022) at SEEL-Systems Engineering Economics Lab, Hampshire, UK. SEEL is the leading international centre for the development of research into real incomes and Real Incomes Policy (RIP). RIP was developed specifically to reduce inflation. This work started in 1975 in the wake of the 1970s stagflation crisis caused by rises in the international price of petroleum imposed as a sanction by Arab members of OPEC. It is instructive to understand that then the stagflation crisis and recovery took over 20 years. Rather than tackle the central issue of real incomes preservation through price and physical productivity incentives, resort was made to monetarism by raising interest rates which further depressed the economy and increased unemployment. The inflationary cycle is characterized by a multi-layered cascade of price increases. Fiscal policy and Bank of England decisions can have no impact on this trend. Based on the 1970s-1990s experience, Hector McNeill, the leading RIP economist, explained that there were four general phases in inflation growth and the extent of its impacts on prices:

- An immediate impact on the principal commodities subject to scarcity created by market imbalance imposed by sanctions, petroleum and petroleum derivatives;

- A lagged broader dissemination of cost-push inflation throughout all sectors of the economy;

|

- A realization that monetary policy and central banks cannot control inflation because real incomes is not the principal policy target and no conventional policy instruments were designed to target real incomes;

- An attempt to compensate for the inability of policy to lower inflation occurs by businesses adopting a price-setting logic that is designed to maintain their real incomes; this can lead to hyperinflation.

|

Although several analysts have stated that inflation will come back down next year, this is very unlikely. Initially, as a result of under-estimates of inflation rises and over-estimations of policy's ability to reduce inflation by government, business holds off raising prices or minimizes price rises. As a result, the immediate impact of energy prices does not feed through into prices in the rest of the economy, it is most evident only in the sale of energy products (electricity, gas, lubricants and petrol). Then later, depending upon the costs structure of different sectors the impact of higher cost logistics, transport and petroleum derivatives, such as fertilizer, begin to affect medium to longer term production cycle industries, such as agriculture, heralding much higher prices with a 12 month lead time to harvest. Following lower agricultural harvests, the different hemispheres enter their cold periods when the impact of energy price becomes critical. In the UK SEEL estimates that petrol and heating energy and food prices will impact the purchasing power of 40% of the population in a significant fashion. At this stage most constituents will realize government cannot do anything by applying conventional policies by taking into account two important facts:

- Monetary policy and fiscal policy cannot do much to stem the inflation other than by creating more unemployment.

- The fall in currency value due to inflation and policy failure, means that businesses need to act in their own interests and accord by setting prices to compensate for this loss. This is achieved by anticipating next-period inflation by building into prices at least this expected rate of price increases.

|

In Brazil, in the late 1970s, these realizations and resulting business actions led to hyperinflation. This is because being the equivalent to an interest rate that is paid to no one, inflation reduces the purchasing power of the currency so that less can be purchased in real terms on fixed nominal incomes. As a result consumption and demand will decline. Therefore, there is a lower volume of output. Fixed overheads increase internal costs, in addition to input costs due to inflation. The business procedures applied to establish output prices become oriented to maintaining net real incomes and margins. This is achieved by anticipating expected inflation by raising prices more than the expected inflation in each subsequent trading period. As a result the driver of inflation is no longer cost-push but includes a psychological speculative element to price setting. This feeds back into the economy to drive inflation even higher. This results in an upwards price spiral or hyperinflation and an eventual monetary and economic collapse involving widespread to mass unemployment. However, the financial logic giving rise to this phenomenon is financially sound for each business but disastrous for the economy at large because overall purchasing power of consumers is destroyed. This fortifies the overhead costs spiral making short term price or physical productivty decisions to lower prices, virtually impossible. On reviewing the limitations of the existing policy options deployed by government it is evident that inflation needs to be controlled through policies that align the interests of companies with consumers who make up the work force. This requires the creation of a macroeconomic environment within which companies are encouraged to adopt business rules that change the price-setting procedures. Price setting needs to maintain a balance between associated gains by shareholders and work forces based on a shared benefit from a combination of price productivity in the short term and made financially feasible by phyisical productivity improvements gained over the short to medium term. In this way it is possible to achieve immediate impacts on the upward movement of prices to alleviate the cost of living crisis faced by an increasing proportion of the constituency. The only policy that deploys appropriate policy instruments to achieve this form of transition in the short term on a sustainable and profitable basis for companies, is Real Incomes Policy (RIP). Last week, a Cambridge Economics Network paper provided an outline of RIP: Options worth considering to solve the cost of living crisisAn important proposition for solving the cost of living crisis Cambridge Economics Network has published an important paper entitled, " Options worth considering to solve the cost of living crisis" by the economist Hector McNeill which provides a transparent justification of a Real Incomes Policy (RIP). The current government promise of cash grants to low income families is stated to be no more than a palliative since this does nothing to stop price inflation. RIP is designed to achieve immediate declines in the rate of increase in prices, to stablize and then reverse them while reducing corporate risk associated with this policy. The paper emphasises that government has very few options under monetarism or monetary policy because this framework has built up an overbearing debt-taxation trap within which any government outlays result in later rises in taxes. Over 25% of the population cannot afford to pay tax with increasing numbers entering the state of "poverty" within which constituents cannot afford to purchase their basic essentials. Most of the constituents within the "poverty" category are employed. This state of affairs is cause by the very high levels of income disparity and the declining purchasing power of the currency. To access this paper click on the image above, left.

The evolving state of the economy of the United KingdomFollowing close to 13 years of applying quantitative easing (QE) which combines monetary injections in the economy combined with very low base interest rates, enough evidence has been accumulated to throw doubts of the efficacy of monetary theory as a foundation for monetary policy. First raised as a problem by the British economist Hector McNeill, policy makers have ignored this possibility. Recently, the Lords Economic Affairs Committee published a report entirled, "Quantiative Easing: A dangerous obsession?" Andrew Bailey, the Governor of the Bank of England, considered the word "obsession" to be inappropriate. However, the evidence given by the Bank of England to the Economic Affairs Committee was entirely unconvincing. Indeed, the evaluation section of the Bank admitted that the Bank was "still learning" about the impact of QE!. Amongst the academic contributions to the Economic Affairs Committee evidence, one emphasised that QE was a policy without a theory. Last year, the Correspondents' Pool of Agence Presse Européenne (APEurope) requested that this media organization sponsor a review of the impact of monetarism on the real economy. APEurope finally asked the Decision Analysis Group that Hector McNeill heads at SEEL (Systems Engineering Economics Lab) in the Hampshire in the United Kingdom, to undertake a review under the general title of " Montetarism and the Real Economy. Several organizations requested that APEurope syndicate this report content so as to create as wide a dissemination as feasible. As a independent syndication medium APEurope agreed to this request. This edition of Real News Online provides an overview of this review prepared by the senior economist on the APEurope Conrrespondents' Pool, Nevit Turk. Nevit Turk has interviewed the author of this review on several occasions in the past an therefore has a good background to assess this latest output. New publication

Monetarism & The Real Economy releasedA free Executive Summary is now available, see below. This document was accepted to make up a whole edition of the Q1-2022, British Strategic Review with the title of, Monetarism and The Real Economy. A general update of this publication and list of contents can be found on the BSR site. In this edition of the BSR the following significant economic issues are presented:

- The Quantity Theory of Money (QTM) is demonstrated to be invalid;

- Quantitative easing (QE) is shown to be a policy without a theory;

- The Aggregate Demand Model (ADM) prejudices the majority of constituents;

- Exploration of options for recovery of the UK economy through the real incomes approach.

How to obtain a free excutive summary

A free epub or pdf executive summary of the BSR is available for download below. Some browsers do not handle epub downloads well so we have zipped the epub to protect it. Therefore the available epub is in a Zip file which needs to be unzipped when downloaded.

How to obtain a copy of the full Review + 12 months free "Notes" service

The full BSR document in epub or pdf formats can be purchased, for just £15.oo a copy which now includes a follow up "Notes" service informing subscribers of advances in the content of the Review since publication. This publication can be obtained on the British Strategic Review website through PayPal using credit or debt cards or through PayPal accounts.

|

|

|

The Review has now been released (31st January, 2022) in pdf format. Readers can purchase a copy using the PayPal card payment link provided on this page. Nevit Turks's overview follows below and his reference document is the syndicated version that has been released under the series title of the "British Stratetic Review".

The BSR, more than a strategic review

Nevit Turk Senior Economics Correspondent

APEurope Paris The British Strategic Review is unlike any other strategy document I have read during the last 30 years. It is unique in that it not only describes how monetarism came to dominate macroeconomic policy but it also traces how some of the events that caused this transition in the 1970s have persisted. This is because the root causes, linked to faulty economic theory, derived policies and inappropriate political decisions helped maintain the problem of energy dependence and income disparity as permanent unresolved issues over the last 50 years.

The review has 10 sections covering different time periods since the Great Depression following the 1929 New York Stock Exchange crash. It is not possible to touch on the considerable amount of original material and revelations in this document so I have limited this overview to the main points of interest but remain aware that it is difficult in the space available to do this work justice. In the section entitled," Further turmoil and the turning of the tide in the 1970s" there were rising concerns with the global ecosystem, population pressure on food supplies and the limits of growth centred around Cambridge, Stanford and MIT but these were pushed to one side as a result of the International Monetary Fund's actions that enabled Arab oil exporters maintain a strategy of price rises designed to punish those who supported Israel in the wars in the Middle East. This led to a seven-fold price increase in petroleum prices within just a decade, starting in 1973. The IMF came up with the idea of recycling petrodollars as a useful buffer to discourage a possible military responses to this globally destabilizing action. Access to these funds were extended through the IMF and from private banks to military hardware corporations and to politicians and political party coffers in the West. The petroleum price was more of an issue of the cost of living to wage-earners but not to those benefiting from the proceeds of recycling and those deciding on macroeconomic policies. Why the book, "The Stages of Economic Development" is flawed

The American economist Walt Rostow published a book in 1960 using the example of British economic development to that point in time, as a case study of the complete cycle of economic development.

The Review points out that, based on hegemonic cycles, that the UK had at least sixty or so years to run to complete what are considered to be final phases. This final phases are always associated with financial speculation and decadence.

The Review covers this period in some detail. Most economists, like Rostow, do not appear to study hegemonic cycles in their training. This field consists of a far more comprehensive systems approach to the analysis of economic development phases based on copious evidence drawn from past hegemonic cycles. Most end, and this will be familiar to readers, in increasing income disparity and social instability, confrontational politics and authoritarianism and warfare. |

|

|

More to Say

Jean-Baptiste Say's contributions to economics are not included in most university economics courses. Sometimes something called "Say's Law" is referred to, almost in passing within the context of supply and demand, where a lecturer or professor might state that this is, "Production creates it own demand". Some even present this an illogical statement and even a cause for amusement. After all, how could this French economist get things so wrong? All rational economists know that demand creates supply, or production.

The Review points out that the British period of economic development between 1945 and 1965 saw unprecedented real economic growth, full employment and declining income disparity, the introduction of the National Health Service a transformative period in the standards of living and health. Those in the supply side production of goods and services sectors received rising real wages. These funds created the multiplier effect on real consumption leading to the need for increasing production. Only about 10% of investment came from banks with most investment and innovation coming from profits and savings. As can be seen, it was the increasing productivity of the goods and services sectors that generated the increasing marginal incomes that generated the unprecedented growth in demand.

Under this regime, which did not operate as a function of the now widely acclaimed Aggregate Demand Model (ADM) applied by monetarists, Keynesians and Supply Side Economics advocates. It operated according to Say's Model of real economic growth based on a Production, Accessibility and Consumption Model.

The subtitle of Say's "Treatise on Political Economy" published in 1803, as a celebration of the concepts of Adam Smith of entrepreneurialism and innovation is, "The Production, Distribution and Consumption of Wealth"; it is well worth reading. |

|

|

It's mechanisms stupid

Hector McNeill studied under David Wallace, at Cambridge, the UK pioneer in the introduction of gross margin analysis and who introduced this as a required part of undergraduate course work. He also studied under and Bruce Lusignan at Stanford who introduced post graduate systems engineering course at the Engineering School. McNeill attributes his preoccupation with mechanisms or the infrastructures of cause-and-effect based on the needs of individuals or microeconomic units, in part, to this early experience and training.

This approach helps avoid the distraction that comes with the rhetoric and levels of assertion associated with the so-called schools of economic thought which tend to hide flimsy analysis and hidden political and personal agendas. Identifying transmission mechanisms, forces economists to make explicit all of their assumptions and as a result helps identify gaps while at the same time communicating the state of relevance of thinking to matters of practical concern. Mechanisms help establish the proof of concepts by building decision analysis models, following the discipline of decision analysis as developed by Ronald Howard of Stanford University.

McNeill applied these approaches in the development of RIP and applied the same logic to explain in very simple terms why the QTM does not represent reality. |

|

|

|

The Review places the reason for this development of the recycling concept and its consequences, at the feet of the Managing Director of the IMF Johans Witteveen. He was a Moslem of the Sufi sect and they referred to him by his other name of Murshid Karimbakhsh. His decision to promote recycling was lauded for "keeping trade going", however, this development and the private sector involvement resulted in slumpflation enduring for more than 20 years into the mid-1990s helping exacerbate income disparity worldwide while petroleum substitution and alternative energy development were shelved largely because of a lack of political interest and foresight. An interesting detail was the fact that two distinct policy options were developed to tackle slumpflation starting our around 1975. One was Supply Side Economics (SSE) and the other was the Real Incomes Approach to Economics otherwise known as Real Incomes Policy (RIP). Although SSE was taken up by the US Reagan administration, it was simply a fiscal scheme involving reductions in marginal taxation in the hope that the windfall funds would result in higher investment in price-reducing initiatives. This "trickle down" notion did not work out in practice because much of the windfall went into executive and shareholder's pockets and assets. Income disparity rose. The Thatcher government tried the same thing. Inflation did fall slightly, but this was a direct result of a decline in the international price of petroleum in the years concerned while income disparity rose. RIP was developed by the Hector McNeill, the author of the Review. This is completely supply side, and its theory is quite different from the Aggregate Demand Model (ADM) the paradigm of Keynesianism, monetarism and SSE. I interviewed McNeill in about seven years ago when he explained that in 1975 he had attempted to write a proposal to tackle slumpflation but could not find a solution applying any of the conventional policy instruments (interest rates, taxation, monetary volume controls and government loans and directed investment) he realized that all of them, if applied, would create severe prejudice for constituents. Having received his economics training at the Universities of Cambridge and Stanford, McNeill found this state of affairs to be unacceptable. He therefore started from scratch to identify the logical mechanisms that create slumpflation in order to identify the theory behind the mechanism. He then used this to design a policy able to resolve the particular issue of tackling inflation by means that do not prejudice constituents and, in particular, wage-earners.

The first issue of note was that slumpflation was clearly caused by cost-push inflation while all of the conventional policy instruments applied under the ADM paradigm assumed inflation to be demand-pull. The Review notes that at that time, and ever since, monetarist advocates, such as Milton Friedman, were never able to describe the actual mechanism of how increases in money volumes create inflation in goods and service prices. The best Friedman could do is assert that this happens in the " long run", but as McNeill observed, " This is not a mechanism". The go to justification for these monetarist assertions is the Quantity Theory of Money (QTM) an identity which by default, is structured to make prices rise with a rise in money volumes but the QTM is not a determinant model because there is are no variables linked to any functions that explain the mechanisms or routes as to how prices rise; the QTM, therefore, was put on notice as being flawed. To finally prove that the QTM is in fact flawed had to await the overwhelming evidence generated by quantitative easing (QE) some 30 years later. The House of Lords Economic Affairs Committee evidence on QE gathered during 2021 resulted in a report entitled, " Quantitative Easing: A dangerous addiction?. The Review points out that some of the evidence presented to the Economic Affairs Committee, refereed to QE as, "...a policy without a theory". The Review confirms this by presenting a step-by-step demolition of monetary theory in the form of the QTM and to present a substitute in the form of the Real Theory of Money as a more complete and more useful identity. By the same stoke, this demonstrates why the QTM is of no utility. The Review calls upon past advocates of an alternative theory to the aggregate demand model in the form of the French Economist, Jean-Baptiste Say (1767–1832) and Nicholas Kaldor (1908-1986) who became the Professor of Economics at the University of Cambridge when McNeill was a student there. What brings these, apparently, unrelated economists together is based on the contributions of these economists to the basic theory of RIP in the form of the Production, Accessibility and Consumption model. First of all Say in his treatise, subtitled, " The Production, Distribution and Consumption of Wealth", published in 1803, emphasized the importance of the role of entrepreneurs in bringing about more efficient ways to deploy resources through innovation. In 1819 Say took up the chair of industrial economy founded for him at the Conservatoire des Arts et Métiers. It is this that links him to Nicholas Kaldor who was one of the first economists to introduce the impact of technology and changes in technology in models of the economy. In 1975, Denis Healey the Chancellor of the Exchequer (Minister of Finance) under a Labour government, abandoned Keynesianism and a wages policy and introduced a crude form of monetarism whose conditions were intensified under the terms of an IMF loan. Kaldor, who had advocated a proactive industrial policy, resigned from his position as an adviser to the Labour government in 1976 to became one of the strongest and most consistent critics of monetarism during the beginning of the Thatcher government. Kaldor's predictions that the impact of monetarism would be a hollowing out of British industry and manufacturing, declines in productivity, rising income disparity and unemployment, and a falling balance of payments under the yoke of monetarism, all turned out to be correct.

Based on the general analyses covering all of the above, the Review then summaries the overall impact of monetarism in the form of a serious constitutional issue that has arisen and made more apparent under QE. This is that monetarism has created two distinct sets of constituents. Those whose incomes depend upon the wages paid by a declining industrial base (the real economy) and those whose income is proportional to inflating asset holdings or transactions. Real wages are declining affecting 98% of voters while asset holder incomes have risen sharply affecting around 2% of voters. The 2% of asset holders are the main benefactors of the Conservative party and the media so the likelihood of necessary change is very small and will remain so until the British political party system is subjected to necessary changes. In the meantime the purchasing power of around 25% of the population in work, has arrived at a low point with many needing to use food banks or take on debt to maintain their standard of living. For most, the standards of living are declining. The Review explains how the recent inflation affecting the UK economy is not just related to supply chain issue or Covid but the mechanism whereby monetarism generates inflation in the goods and services sectors, which always seemed to elude monetarist advocates, is spelt out in very clear terms; the current rise in the cost of living is a direct consequence of monetarism.

The penultimate section homes in on a central issue facing the United Kingdom. Germany, which exists in roughly the same geographic zone of Europe has developed since 1945, reunified with difficulty with East Germany to end up with the largest positive balance of payments in the world consisting of exports of goods or largely industrial products. Germany's balance of payments is larger than that of China a county with over 16 times the population of Germany. On the other hand BREXIT Britain's performance under a continued monetarism presents a sorry state of affairs placing the country as the second to last most negative balance of payments in the world and importing most manufactured goods. This decline over the last 50 years accompanied "free trade globalization" which created depressed rust zones in the UK, today encompassing most of the so-called "Red Wall" areas which were never fully integrated into British economic development and fell behind. The main point is whereas Germany invested in tacit and explicit knowledge-based education and training the UK continued with a highly academic schooling both in pubic and private systems and higher education training system. Monetarism's policy impacts as the deskilling of the British work force has been a disaster. The Review calls attention to how, at school age level, there is a need to introduce a broader technical education in the UK and to move away from " chalk and talk" or "white boards and chat" and even "Zoom".

The final section spells out an approach to initiate the resolution of some of the issues facing the UK economy and society as a whole. Avoiding the clichés of building back better and levelling up, the Review, having set out convincing arguments in support of the role of learning, tacit and explicit knowledge Since the monetarist theory is convincingly debunked in the review with the outcome in terms of policy being self-evident for the majority of constituents, ans the vital role of innovation, takes the microeconomic mechanisms that can transform productivity to identify incentives based on business rules to lower the risk of investment to eliminate inflation and deliver real incomes growth and falling incomes disparity. Options around a central theme are provided. In the final section the quandary of the of how to bring all of this about identifies problems associated with our political party system but pointers to solutions are presented. The Review recalls the outstanding Power Report of 2006 as a demonstration of the resistance to electoral reform by both of the leading political parties. There is, fundamentally a strong resistance to arriving at a state where the constituents of the country contribute in a practical fashion to the shaping of policies that impact their livelihood and wellbeing. There is also the problem that neither of the main political parties offer alternative economic policies. In this context the Review lays bare the fact that both Labour and Conservative parties have both been relentless in their pursuit of monetarism without interruption for since 1975 and Denis Healey's fateful decision to embark on this journey. This was more as a result of panic because the Treasury had over-estimated the government borrowing requirement causing Healey to go to the IMF. There was here a lack of due diligence to double check this estimate on his part as well as an unwillingness to take notice of what Nicholas Kaldor has to say on the matter. Neither Labour of Conservative governments come off well in this Review simply because, to this day, they have both pursued the same monetarist paradigm and therefore aside from rhetoric, they have not offered fundamental alternatives for the people of this country. Until one of them understands that there is an alternative that hold out promise, the country is likely to continue its descent as is the norm at the end of hegemonic cycles. This is a timely document that provokes second looks at how we have managed our affairs in Britain and it provides insights into economics of relevance to economies beyond these isles who, like Britain, need better pathways towards sustainable development.

|

|