A way for Britain to recover

In 2015 I interviewed the constitutional economist Hector McNeill concerning his development of the Real Incomes approach to economics. At that time he reviewed the macroeconomic problems facing Britain and suggested solutions. It is notable that his analysis turned out to have been precise and, as he predicted, the current state of the economy.

McNeill had led the development of the Real Incomes approach since 1975 and recently posted a long Tweet on X. The purpose of this interview was to explain some aspects of that Tweet and in particular as to why poverty has become a notable feature of British society.

Nevit Turk, Senior Economics Correspondent, Agence Presse Européenne, Paris

|

Hector McNeill is Director of the Real Incomes Objective (RIO) Development Programme at SEEL-Systems Engineering Economics Lab.

A graduate of both Cambridge and Stanford Universities he read agriculture, economics and systems engineering.

He initiated the development of the real incomes approach in 1975 when he realized that Keynesian and monetarism could not tackle inflation or stagflation without imposing significant prejudice on the electorate.

RIO is a distinct theory and its policy propositions are designed to close the operational gaps in Keynesian and monetarist policies. The RIO alternative is the only current policy proposition able to eliminate inflation.

Hector coordinates the Strategic Decision Analysis Group (SDAG) and is Editor of this year's British Strategic Review. |

|

|

Nevit: Good to be with you again. The purpose of this interview is to help unpack some of the content of a recent Tweet you posted on X entitled, "No more TINA - There is a definite alternative economic policy". You later updated it with a subheading, "A definite alternative Economic policy for Britain - The consequences of the Real Money Theory". I want to cover some specific points but in particular to understand the reasons for the increasing poverty in Britain.

Hector: Thank you. Its a pleasure to meet you again.

Nevit: You start off the Tweet by setting out the consequences of what you refer to as the Real Money Theory or RMT, why was this?

Theories of money

The Quantity Theory of Money (QTM) identity by Irving Fisher:

M.V = P.Y ..... (i)

Where, M is the volume of money; V is the velocity of circulation; P is the average price of goods and services; Y is the quantity of goods and services purchased, or real income. The Cambridge University economists John Maynard Keynes, Arthur Pigou and Alfred Marshall attempted to improve the QTM but only progressed as far as adding savings (s) to the QTM creating what became known as the Cambridge Equation. (M-s).V=P.Y ..... (ii)Hector McNeill, however, advanced this work far further by integrating all of the principal relevant factors that determine prices of goods and services in relation to money volumes by reducing the proportion of money in goods and service transactions. The RMT represented above indicates that this proportion is reduced by the sums that continue to flow into assets causing more significant price rises in these markets than in goods and services markets. As a result McNeill's RMT identity represents a more complete and accurate representation.

(M-(l+r+p+m+a+h+f+c+o+s)).V = P.Y ..... (iii) Where l-land, r-real estate structures, p-precious metals and objects, m-commodity positions, a-rare objects and art, h-shares, f-financial instruments, c-cryptocurrencies, o-overseas flows and s-savings.

Reference: British Strategic Review, Note 11, "Monetary Deception", 2022.

|

|

|

Hector: Let me shape this answer by creating the notion of a price account. For example, it is assumed that the so-called Quantity Theory of Money (QTM) provides an account of the main determinants of prices expressed as an identity of the product of money volume and velocity of circulation on one side equated with product of average prices for goods and services and their quantities.

[See the first identity presented in the box on the right]

Since 1973, at least in my own experience, the majority of inflation has been generated by rising costs as opposed to the assumption of money volume. In particular a considerable proportion of prices cannot be determined by the volume of money in the economy because they are determined elsewhere are export produce imported to this country including imported goods and commodities. So the stagflation of the 1970s, 1980s and even 1990s was caused by the OPEC petroleum price increases in 1973-1983 when prices rose sevenfold within a decade. Today, we face the same situation with imported gas and petroleum prices determined in association with the Ukrainian affair.

The QTM provides no consideration of imports can have no possible utility in orientating monetary policy decisions.

Unfortunately, Britain has a very high balance of payments deficit in goods signifying that the QTM can provide no support for monetary policy decision analysis of a major component of monetary transactions. The QTM is assumed to represent the prices of goods and services produced in the country. So we are already starting off with a gap in the price account.

The Real Money Theory or RMT is a reconfiguration of the QTM but including all of the variables, mainly assets, that are money sinks. By that I mean they absorb a considerable amount of the money in the economy reducing the amount of money in goods and services transactions including imports. These include in the asset category some eight variables of land, real estate structure or houses and commercial buildings, precious metals and other objects, commodity positions, rare objects and art, shares, financial instruments such as derivatives, cryptocurrencies we then have to include savings as well as an overseas monetary flow balance.

Nevit: If I might set out the difference between the QTM and RMT it is quite notable (see right).

You state that the RMT reveals realities not readily apparent from the QTM. You include, the solution to Friedmanís dilemma, a more comprehensive explanation for the origins of inflation, how monetarism creates a growing structural income disparity & poverty and how monetary decisions guided by the QTM can never eliminate inflation and how companies in maintaining their real incomes while responding to policy decisions actually increase inflation.

Hector: Yes. Friedman's dilemma was his inability to explain the mechanisms whereby an increase in money volume somehow translates into rises in prices in competing companies whose interest is to not raise unit prices and lose market share. In the 1970s, the best he could do was to state that it happens in the long run which is not a mechanism. The RMT format shows that, for example, under quantitative easing (QE) all asset prices rose starving funds from goods and services transactions, and then later, this asset inflation impacts the prices in the output of producers of goods and providers of services as assets such as land, structures and commodities feed into production as inputs and disrupt household budgets.

These rises in costs end up forcing companies to raise their prices as a result of cost-push inflation as opposed to the generally assumed demand-pull inflation. Putting the creation of income disparity and poverty aside the moment, companies faced with rising input costs become particularly concerned with the purchasing power of their cash flow because they need to purchase the next production period's inputs many of which are facing rising prices. To manage this, they apply anticipatory pricing. I first came across this in 1975 in Brazil. This process consists of companies setting their prices slightly ahead of the expected rises in input price rises leading to a rises in output prices that usually exceeds the current inflation rate. Some academics have referred to this a "greedflation". Many initiatives to lower unit costs involve reasonable low cost adjustment to processes which can require loans. However, an important associated practice with anticipatory pricing is that companies begin to sidestep taking up loans because it is cheaper, at high interest rates, to simply raise prices and secure any needed additional cash by bolstering the cash flow.

So, there are two issues here. One is that depressing demand via taxation or interest rates assumes inflation in goods and services is caused by too much demand for goods and services when the issue is rising costs. Therefore, such a policy is ineffective against cost-push inflation. The aggregate effect is a policy-induced rise in the cost of living. The other is the conclusion that basing monetary decisions, such as interest rates or fiscal decisions concerning taxation, cannot eliminate inflation because the QTM assumptions are incorrect and therefore decisions based on that logic cannot maintain the purchasing power of the currency.

Nevit: Very interesting, but then this is quite odd. The QTM has been around for well over a century and economists and policy makers still make that standard assertion made famous by Milton Friedman that, "Inflation is and entirely monetary phenomenon".

In a recent APE workshop you noted that Marshall, Pigou and Keynes did not pick up on this given that the only assets not to have been known when they developed their Cambridge Equation were certain financial instruments such as derivatives and cryptocurrencies.

|

Policy impact preferences

according to sources on income |

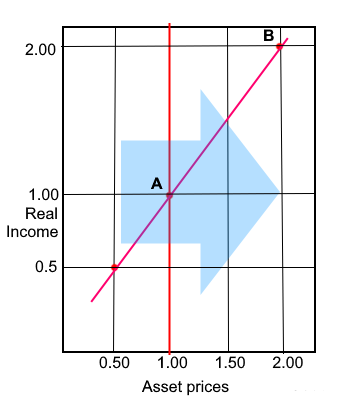

Figure 1: Asset holder & traders

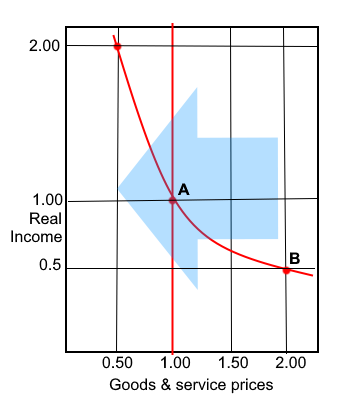

| Figure 2: Wage-earners

|

|

|

|

Hector: Yes, the Cambridge Equation added savings as an additional variable to be considered because it lowers the amount of money used in transactions. But I don't have any explanation as to why they did not extend this further to include assets. They might have been drinking too much port during their after dinner discussions in Kings College and never quite got round to this.

Nevit: Besides monetary policy generating induced inflation because companies financial and pricing decisions to sustain their profits so as to ensure future activities and employment, it gets worse. You wrote that these same policies create income disparity and poverty. This is not looking too good for the Bank of England monetary policy decisions. Whatever they are, it would seem they are irrelevant to inflation control.

Hector: Yes this is a fairly simple and transparent effect. Monetary policy, especially under low interest rate regimes, such as under quantitative easing (QE), favours assets holders and traders. This is because the items traded or held constantly go up in value. Indeed, in asset trading in monetary growth periods traders were able to "pump" the trades by issuing false high priced trades to drive the market up to sell at advantageous prices. This led to traders at NYMEX for example stating that they could "sell anything"., at a profit.

So, in genera, asset holders and traders have a preference for policies that raise asset prices. (As shown in Figure 1 in the box of the left).

Wage-earners, on the other hand, want all goods and service prices to remain stable or preferably decline. (As shown in Figure 2 in the box on the left).

During rising money volume periods (QE) the effects already pointed out, take effect, thereby raising the prices of goods and services so while asset holders and traders see their holdings and commission incomes rising rapidly wage earners see their purchasing power declining. Those associated with assets holding and trading account for perhaps no more than 5% of the working population while wage-earners account for perhaps 95%. There is therefore a certain unconstitutional outcome because this differentiation of benefits arises from the nature of monetary policy decisions.

Nevit: On the topic of constitution, you have stated that the Real Incomes approach is a branch of constitutional economics can you elaborate?

Hector: Well, I just gave an example of how monetary policy favours asset holders and traders. Let me expand that a little. During QE banks and other financial intermediaries did very little to support SMEs and supply side production but instead used the very cheap money to take advantage of the situation to augment their shareholder value and the shareholder values of larger customers. So during QE major purchasers of assets were the banks, while banks provided preferential loans to larger clients to buy back shares to raise their prices purely as a speculative exercises secured through increasing flows on money into the stock exchange. More than 50% of the stock exchange dealings and no funds actually finding their way into actual investment. As a result productivity stagnated.

On the other hand the rise in the stock marker is reflected in the national income as is land and real estate valuation, all counted towards "growth", when in fact, no growth has taken place.

Once inflation has taken off from any cause, the QTM erroneously indicate that it is necessary to raise interest rates and taxes to reduce money volumes or aggregate demand in order to reduce inflation not only on the erroneous logic of the QTM but also on the equally erroneous logic of Milton Friedman's well known statement asserting that inflation is purely a monetary phenomenon. Well, in fact raising interests rates as already explained is inflationary if companies take the appropriate precautions to protect the value of their cash flows.

Constitution is a set of fundamental principles according to which the government operates. It is largely concerned with describing the functions of government and explaining the political system for the selection of MPs to parliaments through elections, to define their responsibilities and scope of action in legislation and with the formation of the government executive and selection of the Prime Minister or head of state or equivalent. A constitution can be a single document to which amendments can be added over time or it can be a collection of separate documents, a body of law, consisting of documented principles, precedents and law.

However, limiting the consideration of constitution to general principles of governance does not protect individual freedom against direct attacks or less obvious discrimination by those governing. Individual freedom can be suppressed by arbitrary political decisions taken and which ignore the preferences of some or all. There is, therefore, a need to build into constitutions additional principles specifically designed to defend individual freedom.

Unfortunately, comprehensive constitutions covering both the principles of governance and including principles for the defence of individual freedom are also insufficient. Constitution cannot be set in stone in this way. How we elect MPs, how they legislate, or fail to legislate, on new as well as stealth legislation, constantly creates pressures eroding individual freedom. More significantly, political parties and politicians have gradually changed the practice of governance in terms of the exercise of their own powers. These subtle changes in practice have not involved changes in law or constitution based upon the approval of the electorate. These have simply ended up as "normal practice" or as components of the British political tradition but which unfortunately erode the individual freedoms of the people of the country. There are also several instances of laws and regulations being ignored or pro actively abused by governments. The principal institution established to defend individual freedom, the jury, has been subjected to a persistent pressure to reduce and eventually remove its role from legal provisions.

So what are the signs that such political decadence exists and might be affecting individual freedom?

A constitution is Constitutional economics relates the constitutional norms of a country to the effects of how the constitution is managed upon the economic wellbeing of the national constituency. As Buchanan has stated, a constitution should last for several generations whilst being able to safeguard the interests of a constitutional trilogy made up of the state, society and each individual. This is maintained through the process of public choice whereby the electorate agree on moral laws and regulations as upholding the interests of that trilogy. This process does not consider the state as having any superior motivations or wisdom to those of the electorate and therefore those administering the state or government in acting within the established laws and constitution should not take decisions at variance with the established laws. This also rests on the caveat that decisions or regulations or even laws that have not been subjected to public choice are null and void because they have not been authorised by the electorate.

|

|